CRU has launched a new European cold heading quality (CHQ) wire rod price assessment in response to increasing demand for an assessment to support the fastener and fixing industry. The new price series will assess 20MnB4, considering both spot and quarterly transactions to reflect market trade.

CRU is already assessing prices for low and high carbon wire rod in Germany, Italy and Spain. With the addition of this new price series, the company will be able to provide clients with a wider variety of wire rod price assessments for Europe.

CHQ wire rod is the raw material used for the manufacturing of fasteners and fixings, including bolts, screws and rivets, which serve a variety of markets, including the automotive and construction industries. CRU expect these key end use sectors to grow significantly over the next few years, with light vehicle production growing at a CAGR of 2% from 2024 to 2028. Similarly, spending on construction will grow by a CAGR of 2% during the same period. This new price series is therefore well placed to serve the needs of suppliers to these industries.

The new CHQ wire rod assessment will cover the grade 20MnB4 defined by its chemical composition, comprising manganese (0.90 – 1.00) and boron (0.002 – 0.004) amongst other (C, Si, P, S, AI, Cr, N, Ti). The core dimensions for this product are 5mm – 15mm, anything larger would increase the risk of introducing strain into the wire, although select producers have capabilities to offer sizes up to 60mm.

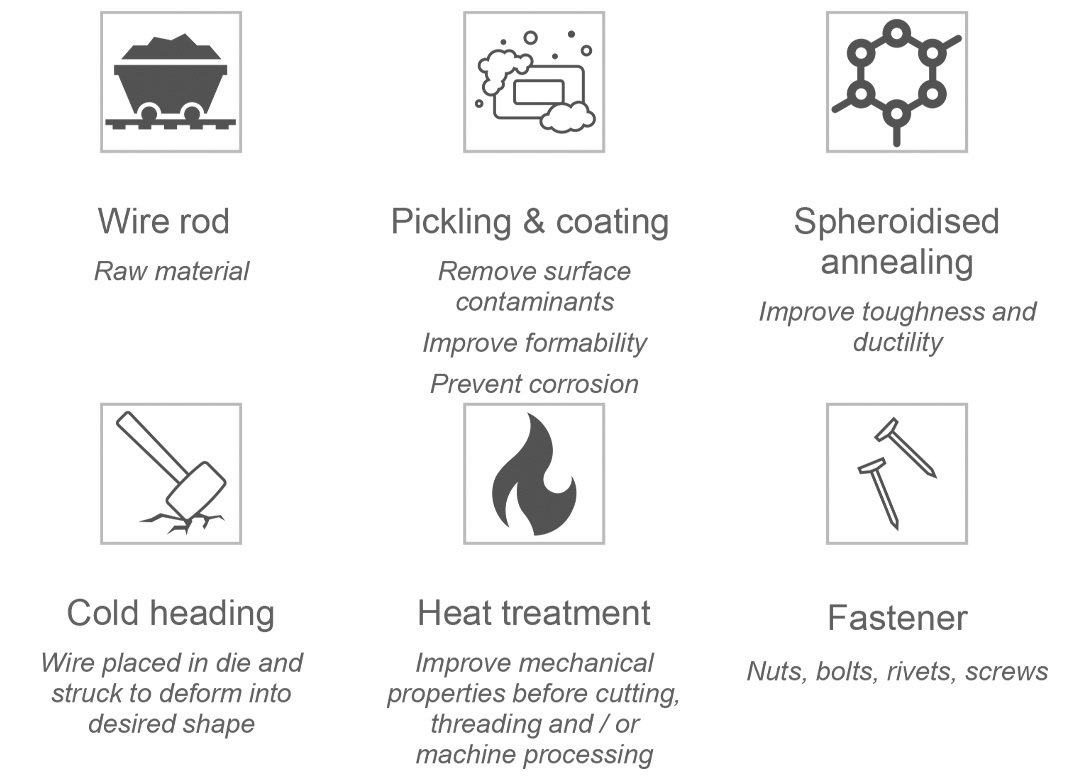

Fastener manufacturing

The manufacturing process of fasteners comprises of four steps, the first of which is pickling and coating, where surface contaminants are removed to improve formability, as well as prevent corrosion. This is followed by spheroidised annealing to reduce the hardness and increase the deformation potential of the wire rod to achieve the desired mechanical properties of the fastener. The wire is then placed into a die and struck to deform it into the desired shape, known as cold heading. Finally, the rod is heat treated to improve the mechanical properties before cutting, threading or any other machining process takes place.

The CHQ wire rod market is principally contract-based, with quarterly and bi-annual contracts – although monthly negotiations were common during the highly volatile period immediately after the war in Ukraine began. Therefore, CRU will assess the CHQ wire rod market monthly while considering both spot and contract transactions.

In-line with CRU’s existing European wire rod prices, the unit and currency for the CHQ wire rod assessment will be Euros per tonne on a delivered basis.

Although the market dynamics are mirrored in all LC, HC and CHQ markets, the data for CHQ demonstrates significantly less monthly volatility, which is expected given the contract-based transactions.

Looking at 2023, the effects of the war in Ukraine, as well as primarily high inflation and high interest rates, impacted both LC and CHQ demand, as confidence in the construction industry was eroded. Whilst CHQ prices normalised abruptly in the beginning of 2023,

they remained stable in Q2 and Q3 of 2023. Most recently, contract prices have been setting in a range of €730 – €780 per tonnes delivered,

which represents a €150 – €205 per tonne decrease since the beginning of 2023.

Where is CHQ wire rod produced?

The major produces of cold heading wire rod are concentrated around western and central Europe and include Voestalpine, Saarstahl, Caleotto, Trinecke Zelezarny and British Steel, amongst others. Major processors of CHQ wire rod – wire drawers and fastener manufacturers – have a large presence in northern Germany but are also located in western and southern Europe.

CRU’s methodology for European steel prices can be accessed here: https://cruprod.blob.core.windows.net/media/ibsdlgby/cru-prices-methodology-and-definitions-carbon-steel-august-2023.pdf

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.