Here Peter Standring, technical secretary at Industrial Metalforming Technologies, will endeavour to identify the nature and sources of information that will help fastener manufacturers, distributors, and customers, to obtain the practical data on which sensible business decisions can be based.

It’s an amazing consideration that, out of the ‘known’ universe (literally countless numbers of galaxies each teaming with unimaginable numbers of stars and planets) the Earth appears to be the only one with life. Also, that of all present and past forms of life, humans have been the only ones that have traded goods with billions of transactions taking place daily. It is just beyond comprehension, but it happens, and it happens because, somehow, we have evolved it to be so.

In short, there are only two parties required for such transactions – the seller and the buyer. The simplest things to sell are natural resources, the value often being in their scarcity. As an alternative to natural resources, skilled and industrious people take these natural resources and turn them (often through manufacture) into a valued product.

Markets took a natural evolutionary step to bring those with something to trade together with others who wanted to buy. Step forward the middleman who, recognising both a need and a potential trade, found ways of squeezing between the seller and buyer to make life easier for them both – at a profit of course.

It was the adventurous middleman who found ways to cross territories, boundaries and seas with their search for trade. With them spread linguistics, numeracy and technology transfer. The ‘organisation’ of communities into substantial groupings led inevitably to hierarchies, governance and regulation (control of trade and taxes).

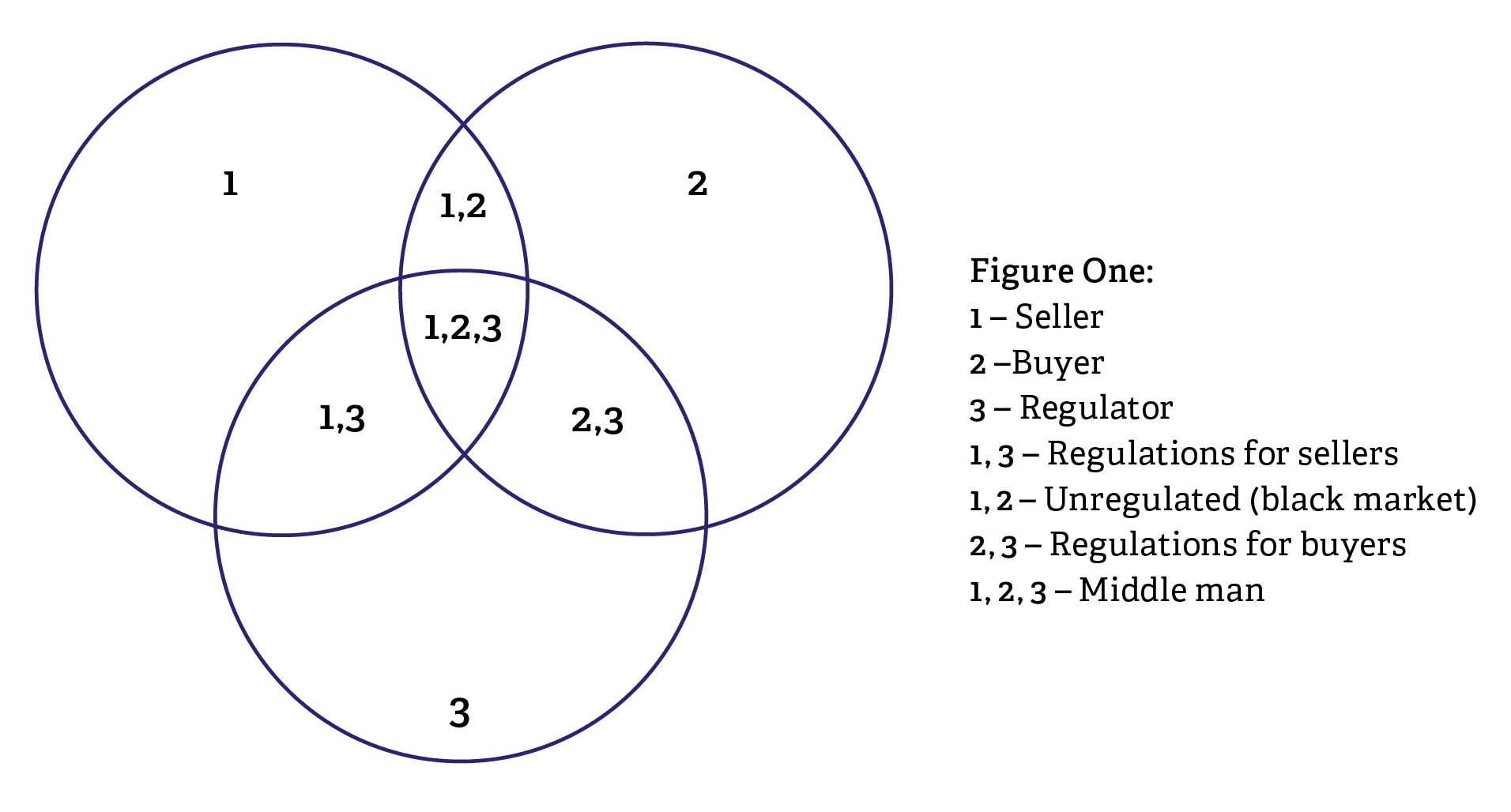

Today, the self-same system exists globally as shown in Figure One although often with digital speed, significant complexity and a demand on resources that can threaten the planet.

Big data

In the days of pen and ink, most industries were nationally based. The business model was often of merger and acquisition to achieve growth. Much like a spread of investment interests on the stock market mitigates risk, so industrial groupings were formed incorporating many diverse sectors. To aid and support these, the corporate body often formed centralised R&D, training and library facilities on which all members of the group could call. The costs of these group resources were imposed by corporate headquarters on all trading group members. The benefits to each group member; a few free hours of R&D time, group training and library research. Justification for maintaining a library was the monitoring and targeted circulation of potentially relevant information to those who registered for it. This service provided a free to use conduit for dissemination of data by those who had the expertise to obtain it.

With globalisation, many national industrial entities became international or selected parts were subsumed into existing global groupings as the digital revolution took place. Once a national group was split, shared group facilities were no longer necessary so, the R&D, training and library (data services) were dispensed with. The companies that moved on to become players on the international stage as part of global enterprises simply adopted the new corporate cultural norm and the support facilities they provided – 24/7. Those left behind, as perhaps part of a management buy-out, immediately felt both the freedom of independent action and the ‘chill wind’ of being alone.

It is perhaps no surprise that what once had been a fertile ground for national technical conferences, trade association membership, customer dinners, golf tournaments and the like, very quickly transformed into digital communication and much longer hours on the frontline. The rapid uptake of social media by business, as well as the development and use of the internet, has condensed all aspects of the industrial world into huge blocks of readily retrievable data and in turn, changed the world.

Online multi time zone meetings and 24/7 working have shrunk the globe to virtually ‘matter of fact’ status. Buy before a certain time and despatch the same day. All kinds of continuously monitored and recorded statistics through supply chain partner portals will show how good you are at providing reliable customer service.

The participants

Although the term ‘supply and demand’ is always used in that order, in reality it must be the ‘demand’ for something that comes first. Assuming the ‘demand’ exists, then suppliers of goods must seek to provide them at a competitive price. For manufactured goods, the primary supplier is the manufacturer themselves.

As shown in Figure One, those who sell, must also have a source. For manufactured goods, this requires materials, labour, premises, equipment, transport, etc. In short, all the elements (direct and indirect) that are required for any modern manufacturing enterprise.

Recognised national and international industry quality standards provide the basic framework within which manufacturers must perform. These are supplemented by internally devised and applied systems that ensure both efficiency of production and monitored quality of output. It is the continuous measurement of all inputs and outputs, and their statistical analysis, that provides a manufacturer with the justification to price the products at a knowingly competitive value. To be ‘knowingly’ successful, the monitoring must be rigorously applied throughout the whole manufacturing process – including the supply chain. Since this cannot be done in isolation, manufacturers must always be seeking to benchmark their own operations – at every level including management – against their recognised major competitors. In doing this, the data obtained and applied by the manufacturer is the ‘gold standard’ by which they are judged.

The middleman in all transactions does not have the worries of the manufacturer but does have to be aware, and confident, in the competence, quality and delivery of those they buy from. This may not be of significance where the middleman (distributor) serves a general, non-specific market where quality issues rarely have any feedback. However, where quality audits and traceability are an essential factor, the necessity for this is both onerous and costly. The commercial data on which this business is based is its ‘street cred’ and once obtained, will ensure its valued place in the market.

In Figure One, the buyer section is interesting since it represents the user who could be either the person purchasing a screw or a major OEM based in automotive, aerospace, construction, etc. A member of the public may seek a small packet of fasteners from a hardware retailer, the commercial purchase could involve a wide range of products in significant volumes. These could be ordered/reordered for Just In Time (JIT) delivery to OEMs, tier one, two, suppliers, etc, or to distributors/retailers. The importance here, is the reliability of supply to meet the actualities of demand.

The final participant in Figure One is the regulator. These are generally government appointed representatives involved with a wide range of activities including taxation, import/export, health and safety, legalities, etc. The potential influence of the regulator for both national and international trade can be positive, negative or benign for both fastener manufacturers and users.

Sources of Business Intelligence

For years, the phrase ‘It’s not what you know but who you know’ has been the mortar that has been considered as holding the business bricks together. Globally, the family, the school, the group, the obligations, all, depending on the cultures where they are found, contribute to the unseen and often unknown network of contacts. Although still in existence and well practised by those with ‘power’ (and amongst others trying to climb the slippery pole to join them), the evolution of social and business media digital platforms have significantly eroded the importance of closed networks.

Today, meritocracy is evidenced by the growing numbers of those who have embraced the digital ‘tech’ world and used it to achieve the financial escape velocity required to accelerate into the multi-million and billionaire mega sphere.

Others, who remain ‘gravitationally’ tethered and have no desire to enter the supply chain as a purveyor of goods, often employ their time trawling cyberspace to dredge up information, which they can sell. Perhaps the most well known example is that of the 24 hour newsrooms, which continuously track the outflow of digital information from whatever source and vie with each other to capture a ‘scoop’. Consultancy companies do likewise but in their case, they have targeted markets, for which they produce ‘overview reports’ using past data and prognosis to second guess the future. Naturally, information that might suggest the making, saving or loss of business are likely to encourage those at which a report is aimed to purchase a copy – they rarely come cheap. Benchmarking your company against the best of the rest is always a good seller.

However, just as in the case of 24 hour news outlets, where those who report the news are always in danger of making the news; so too in consultancy, only when the watch they have borrowed to tell the time goes wrong, do they risk anything other than obtaining one hundred percent success in their predictions.

The reason folks still publish books and texts of Nostradamus’ prophecies is not because of their accuracy, but because large numbers of people obsessively wish to know what is written in the stars. Consultants, if they are any good, have access to lots of published data on which they can base the contents of their reports. This data is often supplemented/supported by direct contact with individual selected commercial sources.

As any chef or cook will tell, it’s what goes into the mix that largely determines the quality of the outcome. Sure, cutting, heating, stirring and serving all contribute, but without the correct ingredients, it will only ever be what it is.

Time spent learning where to collect meaningful data and doing that on a methodical and cyclic basis (which can be added to and massaged as and when desired) will provide any organisation with the independent information they deem necessary to ensure their company stays aware.

At the top of the list of data might be the global concerns that could significantly influence trade. These include sanctions and embargoes, trade restrictions/tariffs, supply chain problems (plant closures, shipping/transport, industrial strikes), buy-outs, bankruptcies, etc.

At a local level, difficulties could include local authority issues with roads/deliveries, environment/levies/restrictions, trades unions, community action groups, etc. The commercially focussed reporting of consultancies and the generalisation of information gathered from membership of trade associations can never provide all the individual knowledge that an industrial company requires to at least be aware. Like most things in life, you get what you pay for. So, if you don’t care that you are not aware, the probable protection you have from the vagaries of life will be what you pay – nothing. Alternatively, appointing one, or more persons to cover the ‘information’ roles at, global, regional and local levels and having them flag up any potential concerns will (a) make the company ‘aware’ of any issues that may/will affect it and (b) give justified cause to take matters further.

In addition, any viable plan requires reliable information on which it is based. The identification of specific ‘trends’ from the data collection will provide for the realistic planning of ‘what if’ circumstances.

This situation is true for the manufacturer and is the same for every player in the supply chain including the buyer/distributor. For those in a well constructed and established supply chain, the setting up of regular formal data sharing sessions will not only enhance the confidence of all those involved but also provide a forum where others along the chain could contribute their own experience in dealing with particular issues. As the global manufacturing industry continues to coalesce into fewer supply chains, the more a supply chain partner can contribute, the more it will be valued.

At a manufacturing level, the greater the degree of ‘real time’ data of the production process a company holds, the greater those upstream controlling the demand will have confidence in maintaining the supply partnership. Doing this of course requires data acquisition and storage of all production/scheduling/handling information. It should be recognised that no matter how efficient a manufacturing centre may be in utilising the best tooling design, equipment, process control, and handling, a lack of awareness of problems external to the plant – both up and down stream – could ruin all the investment, planning and good practice.

Conclusion

The phrase ‘lies, damned lies and statistics’, often attributed to Mark Twain, is used to denigrate what is often an ‘inconvenient’ truth. The accurate and continuous monitoring and presentation of any and all activities, can only provide an objective assessment of what has taken place. The interpretation of what this may reveal and any decisions based on it regarding the future are – unless AI is involved – human centred.

For global information, the United Nations, World Bank, as well as a host of other global entities, all provide ‘free’ data on every aspect of life – including manufacturing supply and demand.

In the same way, regional bodies, trade groups and national bodies collect and present statistical data on imports, exports, sales, trends, etc, most of which is generally free of charge.

At a local level, municipal authorities collect their own data including electoral registers, industry and employment, amenities, etc. Bodies like the Organisation for Economic Development and Cooperation (OECD) span the local and global by offering data to companies that seek to have global linkages between potential local level business partners.

In short, any company, large or small, can do what any major consultancy provides by spending just a few hours online finding sites where the data they are interested in can be accessed. It then requires just a little thought in identifying which information sites are most useful and then setting up a ‘regular’ data collection and monitoring system. How this is presented, reported and developed is a matter of preference. What is fundamentally important is the quality of the data obtained (accuracy and reliability) and the decisions that are made using it. In truth, it’s not that clever to tell the time but it is if you don’t need a watch!

Biog

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.