Here Peter Standring, technical secretary at Industrial Metalforming Technologies, seeks to identify and evaluate the key issues that companies in the fastener supply chain should be considering in these changing times.

It is this author’s contention that the most important human invention was the ability to take two entirely disparate objects and use a third to fix them together. This ability made it possible for people to produce clothing, shelter, tools and everything we find in the modern world.

When humans first began to fasten things together is lost in the mist of time. However, wherever early humans ventured, these skills were always present and remained so within nomadic and isolated cultures. Agricultural skills and the need to cultivate fixed areas of ground necessitated groups of people living in close proximity. The shared interests of these groupings and the need to defend what they had from other groups created the world’s first requirement for mass production. The larger the groupings, the greater the demand for manufactured goods to supply them.

The rest, as they say, is history. Big groups, which are successful, grow bigger and to sustain themselves need to grow ever bigger. Success creates envy and at some point, an internal or external threat will cause the brick walls to tumble. As in the case of all successful empires, the armed forces always provided the hot air that kept the whole show airborne. To do this, the Roman Army, the Terracotta Warriors of China, the Athenian Fleet, etc, were all equipped using centralised, mass production facilities owned and run by ‘the state’.

Clearly, the larger the empire, the bigger the forces required for its defence/expansion, which in turn offered the benefit of ‘economy of scale’ from the use of standard parts.

The growth of the Industrial Revolution

It was not until the rise of empires, followed closely by the Industrial Revolution, that the various states began making or ordering standard military equipment for their armed forces. The development of production equipment by individual entrepreneurs for their own use or for general sale meant the manufacture of goods was limited only by the availability of the raw materials required and the markets they supplied into.

The scale of the market being served determined the size of the manufacturing operation and its need for raw materials. The growth of one meant growth of the other. Local centres for the manufacture of specific goods evolved because they matched the locations for supply and delivery, together with the environmental aspects required. Success created employment, which in turn produced specialisation. This concentrated industries in regions that became synonymous with the goods being manufactured. Around these grew sub supply chains, which served the needs of the local manufacturing base.

Trade has always been ‘international’ long before many parts of the world had nations. Raw materials collected in remote regions were carried to population centres where they could be furnished into semi and finished goods. These were then transported to other centres for direct resale or for distribution by travelling traders.

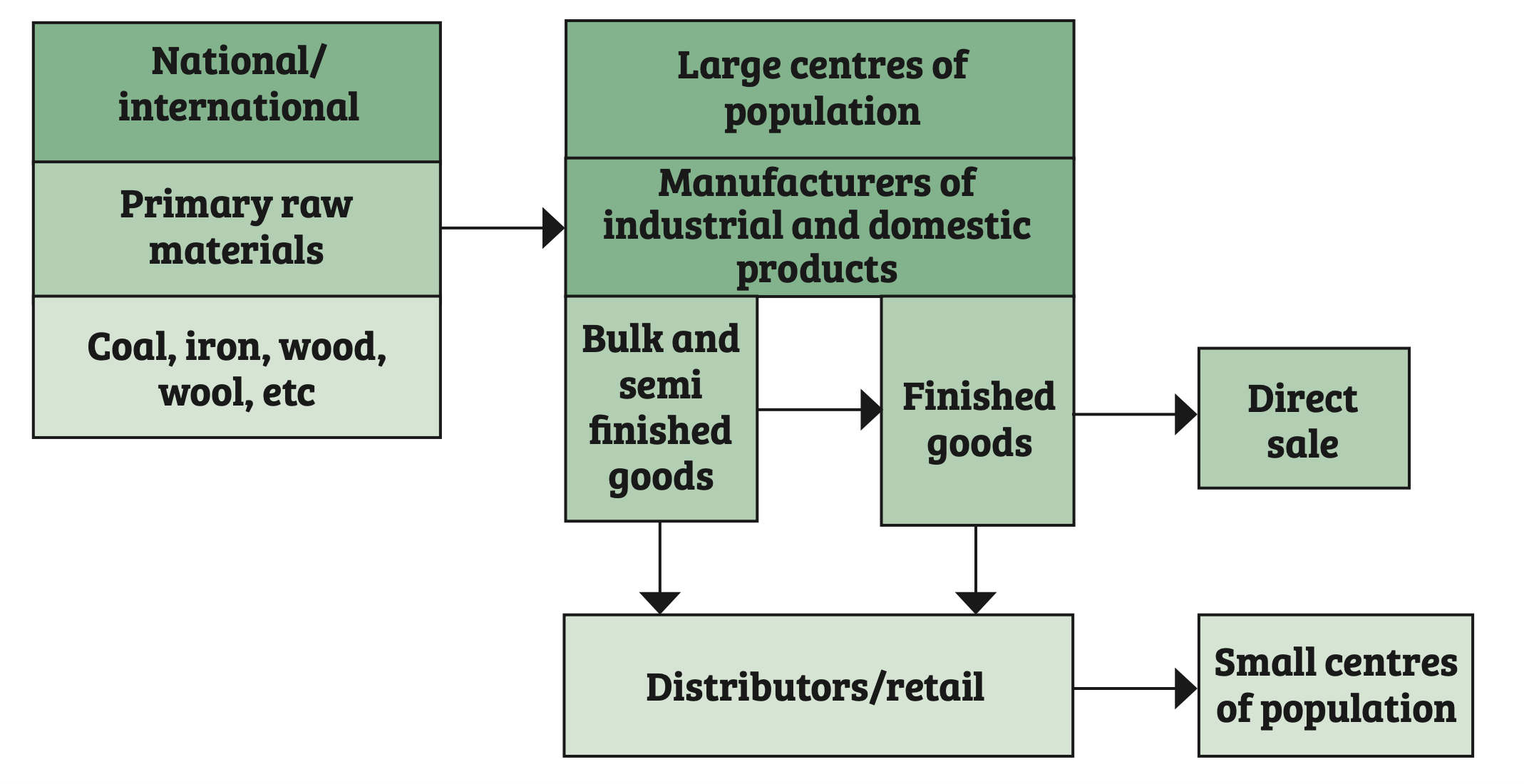

In small centres of population – towns or villages – the local need for trade persons was met by blacksmiths, carpenters, builders, etc. In larger centres of population, local manufacturers produced locally finished goods for industrial and domestic use. Figure One shows this supply chain as it developed in the Industrial Revolution.

Primary raw materials became more ubiquitous as the ever increasing rates of machine output and demand expanded, causing the local sectors of production to grow. Areas specialising in certain products became synonymous with regions where local manufacturers focused on particular goods. Equipment, skills and attendant sub supply chain elements gathered in all regions where these facilities were required.

Interestingly, this aspect of ‘collective localisation’ of specialities has been continued as national manufacturing has expanded internationally. From shoes to ships, ceramics to automotives, manufacturing centres for such goods appear to congregate in collective groups. This makes sense because it focuses the supply side, much as the establishment of local markets and, more recently, shopping malls have for consumers.

A global presence

The industrialisation of warfare as witnessed in the 20th Century changed the world. The global nature of both world wars and the unending demand for more of everything gave rise to the need for interoperability within the supply chain. Goods in the wrong place at the wrong time or the inability to produce them to the correct standard, simply reconfirmed the military axiom that, logistics win wars. Simplicity equates to efficiency. In terms of manufacture, this ‘always’ begins with design. The myriad of state funded wartime knowledge gained in identifying a need; agreeing how this could best be achieved whilst working inside a clearly defined envelope of practicalities; creating the working groups which could deliver the goods; and bringing all the necessary elements together to obtain a successful conclusion; produced countless years of ‘on the job’ training.

Following such endeavours, and with a new world to build/rebuild, the demobbed army of trained experts covering every aspect of peacetime requirements, poured out into the various communities to create a world for themselves.

Of course, in the post war period, the free trade rules of ‘borrow today and pay later’ no longer applied. This meant the previous global presence was rapidly shrunk to within restored national boundaries and tariffs imposed to protect national interests.

At the global level, post 1945, the cooperation to create international forums for political, financial, trade and health, etc, provided the stable conditions which world trade requires in order to function.

As always during times of conflict, there has been a race to improve technology. For the fastener industry, the cold forging of steel developed in Germany in the 1930s, using a conversion coating on the billet to hold the lubricant, was a major breakthrough and a state secret. This was picked up by post war UK and USA manufacturing specialists and was further developed within state owned R&D laboratories. So important was cold forging considered as a means for enhancing manufacturing technology, that, in 1961, it received Organisation for Economic Development (OECD) funding to increase its widespread industrial development/uptake.

Modern supply chains

The development of modern supply chains can be traced to 1989 and the fall of the Berlin Wall. At an instant, the need for defence spending in the West virtually disappeared and the ‘hot air’ that previously maintained it was significantly reduced. This transition allowed huge swathes of central and eastern Europe to replace the former communist economies. Like a released vacuum, the previously unenergised populations were greeted by an infusion of Western interest and goods. With well educated, low cost labour and citizens desperately requiring the means to establish a sound financial basis on which to build a future, major manufacturers flooded east scattering state of the art production/assembly facilities to wherever profit could be obtained.

The political benefits were clear – to integrate the previously communist countries into the democratic family as quickly as possible. For OEMs, the creation of super efficient plants in the East made many of the existing plants in the West economically redundant; so they were closed.

Growth now became the word that those involved in finance saw as the goose that laid the golden egg. More growth (demand) meant more people able to afford the badges of success, which money could buy.

A few months before the Berlin Wall came down, China had experienced its own breeze of democracy and ended it abruptly in Tiananmen Square. The ‘command economy’ was modified to encourage direct trade with the rest of the world, the success of which created huge inflows of foreign currency – resulting in, the ‘China Price’.

At the end of the 1990s when the central and eastern European tsunami was subsiding, China’s induction into the World Trade Organisation (WTO) provided the renewed booster to manufacturing ‘growth’. Having established a manufacturing base, the Chinese government promoted the prospect of ‘growth’ at least an order of magnitude beyond that experienced through expansion into central and eastern Europe. The message around boardroom tables was: ‘If you are not in China now, it is probably too late!’ The rush to offshore along with the ‘China Price’ caused the closure and loss of networks of local suppliers built up over many years to serve a near to hand business sector that now resided thousands of miles away.

Huge, automated assembly plants with adjacent satellite supplier companies offering scale of economy efficiencies, which only the largest investments can match, today represent the current peak of mass production excellence. One of the key developments that has made this possible was the recognition in WW2 of the need to have standard parts. If there are many things that do the same job, choose one, make lots of them and dump the rest.

Today, standardisation is everywhere and in the wake of the efficiency and cost savings it brings, disappear the talents of the personnel who worked and competed on the multiplicity of components that now no longer exist.

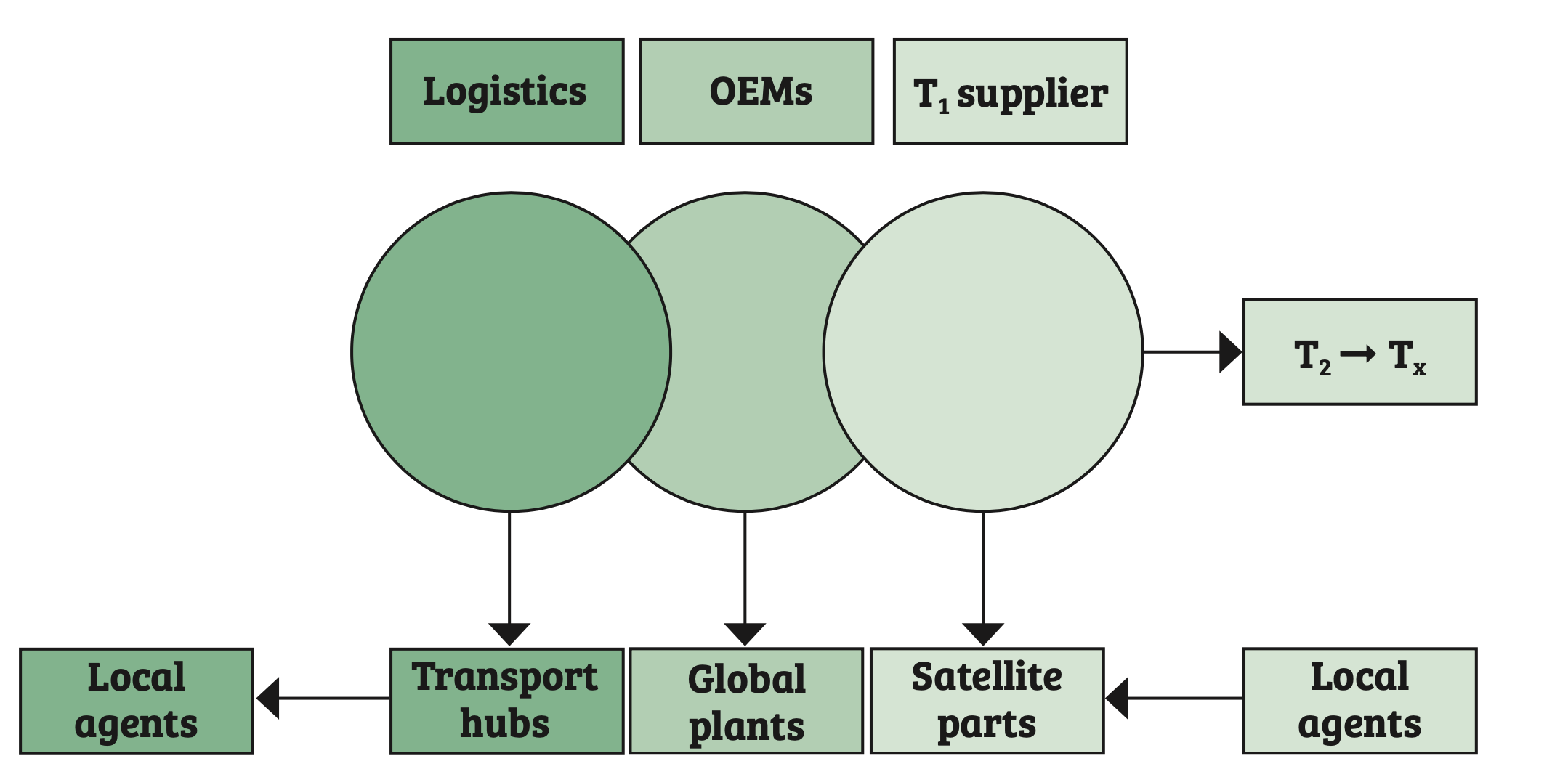

Figure Two provides a general outline of modern supply chains. It should be noted that all mass production global manufacturing plants irrespective of their location are built to this model and generally, with a defined lifetime – with it being more efficient to design, build and equip new than to retrofit a pre-existing facility.

Where to from here?

It is likely that throughout history, virtually all leaders would subscribe to the Darwinian view of ‘survival of the fittest’. However, most would construe fitness with strength and the ability to dominate. The term, ‘fitness’ used by Darwin referred to the ‘ability’ to survive, which need not require strength. For instance, small mammals succeeded dinosaurs.

The supply chain model shown in Figure Two has not been developed by accident or through trial and error. It has been arrived at through a combination of many factors that make it possible. Digitalisation allows the collection, storage and dissemination of data. The use of data, coupled with transportation links, makes global logistics functional. Data, from design to legacy – including every aspect of scheduling, manufacture, and finance – makes the modern supply chain operational. However, the key to this remarkable global success story is, ‘stability’. Throw a huge spanner into the precisely balanced mechanism and it stops. For example, introduce a significant loss in communications due to an enormous solar flare, an ongoing pandemic, a major (possibly nuclear) war and the whole super efficient edifice will collapse.

Concerns regarding the existing and potential threats that could overturn the apple cart are always being considered in all OEM boardrooms. Strategies for mitigating risk include reshoring overseas manufacture to the home base; relocating current manufacture to another low cost (stable) country; and bringing previously outsourced manufacture in-house. In short, ensuring control.

In the three decades that the ‘growth’ economic model has been rolling, it has had multiple manufacturing ‘churns’. This has included building global manufacturing facilities and the supporting networks, rationalising/sharing design/production techniques and using web-based 24/7 working to reduce time to market and maximising resources. Where the OEM goes, the supply chain partners must follow.

Given the prospect of global instability, that could be at least an order of magnitude more severe than what has been faced since the Covid-19 pandemic, new strategies for manufacture will emerge. This will naturally be costly and involve unwanted effort. However, picking the fruit before a pending storm knocks it to the ground makes sense. Just as the previous period of ‘growth’ was achieved on a step-wise basis of relocation, any new model for global manufacture will take place in a similar way. The fly in this particular geopolitical ointment arises when the focus on building stabilisation creates ‘blinkers’. Although well intended, these ‘blinkers’ obscure the wearer from other potential distractions as in the case of the Russian invasion of Ukraine. When someone says they won’t and then they do, the ensuing instability destroys any hope for efficient manufacture.

Despite the myth of some earth destroying global ‘flood’, as long as there is more land unaffected than has been inundated, once the tsunami recedes there should always be someone to clear up the mess. Moving stuff from low lying threatened areas beforehand will make the economic ‘fall out’ much easier to handle.

Since February this year the manufacturing world has seen a shift in the direction of flow of goods and services. At present, this may not be huge in the scheme of things, but the sirens have already sounded. The supply chain model that emerges will not be based on hope but on tangible assets, which can be exploited. When OEMs first marched across the globe and suppliers set up their shiny new facilities alongside them, they used their home-based supply network to match the increased demand. This was followed by tier one’s obtaining potential local suppliers in a new location, often paying the home-based suppliers to provide on the job training and certification. Then, when tier one moved all or most production overseas, their existing supply network became expendable and was cast adrift.

In the late 1990s, within the European Union (EU), there was a glut of steel making capacity that exceeded the demand. This resulted from enlargement of the EU and the fact that most member states had their own steel industry. At that time, the world output of steel was around 750 million tonnes. In 2021, China produced ~1.79 billion tonnes of steel, which was almost two and a half times more than the rest of the top twenty steel producing nations combined.

Perhaps a new trend will emerge in manufacture where smaller, more numerous plants produce a greater diversity of product? The airlines are choosing smaller more efficient passenger aircraft over jumbos, small scale nuclear power plants and mini steel mills also feature in modern thinking. Although the global population keeps increasing, maybe manufacturers have come to recognise that the ‘economies of scale’ model is getting past its ‘sell by date’? This could perhaps be replaced by a manufacturing model that maintains the benefits of Just in Time (JIT) but enhances it with, Where Required? This could certainly reduce the carbon footprint of manufacture and aid in establishing control over both production and the lifecycle of goods produced.

And the fastener industry?

When supply chain security is threatened, twin strategies are followed. One, to sort out the threat and, simultaneously, to seek alternative sources of supplies. The scale of economies that large volume fastener manufacturers have established and run successfully during times of stability may not be viewed that way in times of uncertainty. Of course, large volumes justify the scale of investment, which makes economic sense. However, if OEM customers required local manufacture at their global and home-based sites, then the large volume fastener manufacturers’ economic model will require serious revision.

Likewise for smaller, locally based fastener manufacturers. Interest from home-based OEMs and tier one’s for new supply contracts would require significant development of their own supply chains. In short, a reestablishment of a supply-side service arrangement, which existed before the rush for growth took hold.

Given the current political situation, which has in large measure led to where we are now, it might be a sensible option for politicians to abandon the constant cry for economic growth and instead call for ‘stability’. In parallel, they could begin by providing support to reestablish credible local manufacturing networks along with direct access to the resources they require to make them function.

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.