A review and preview of the global fastener market

Named after the Roman god who is often depicted as having two faces – due to its ability to look to the future and to the past – the Janus Perspective is a unique feature that includes a wide cross section of global fastener business leaders, who have all contributed their retrospective of 2021 and thoughts on prospects and challenges for 2022.

Fastener World Magazine

In the first ten months of 2021 Taiwan’s global fastener exports totalled US$4.32 billion (€3.81 billion) – already surpassing the pre-pandemic level of US$3.96 billion in 2020, which itself was down 8% on the US$4.31 billion in 2019. In fact, the final export numbers for the whole of 2021 could inch closer to the US$4.6 billion in 2018.

Taiwan’s economic growth was 2.73% in 2019, 2.98% in 2020 and expected to be 6.1% in 2021 by the Taiwan Institute of Economic Research, and even 6.6% by Morgan Stanley. The scourge of a disrupted global supply chain rolls off Taiwan’s fastener industry like water off a duck’s back. Taiwan is blessed to be one of the rare countries performing well in export given the current global landscape.

The post-pandemic era has turned the macro-environment into something that can take control over fastener companies. A higher proportion of outsourcing and foreign labour could mean a higher risk to bear. Large companies differentiate themselves from competitors through equipment upgrades, mass production and investment. While small companies survive and develop upon profits and overtake competitors through mobility and agility.

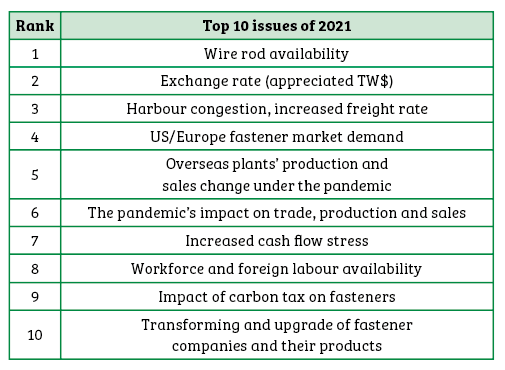

As always Fastener World Magazine embarked on its annual survey of Taiwanese fastener companies towards the end of 2021. Included within the survey was a list of ten issues of 2021 and companies were invited to evaluate each issue for the level of impact and rank them. Based on feedback from 82 companies the top 10 issues of 2021 were:

This underlined that the biggest concern after the pandemic outbreak was wire rod availability, which created considerable cost stress for Taiwanese fastener companies – as a result of global rising steel price over the past two years.

Overall, Taiwan’s export has been robust since the second half of 2020 resulting in a trade surplus and because the Central Bank of Taiwan didn’t actively adjust the exchange rate, the New Taiwanese Dollar has appreciated and remains strong among the Asian currencies, with a prospect to remain strong through next year. This would explain why the exchange rate is placed 2nd in the chart.

As for the harbour congestion and increased freight rate this year, this issue is to continue through next year with no easy way of resolving the issue. Whilst these top three concerns remain, Taiwanese companies’ shipments will be obstructed and revenues will decrease – despite a strong US/Europe fastener market demand. Therefore, market demand is not the determining factor for corporate sustainability in the wake of the pandemic outbreak.

To small and medium sized Taiwanese companies the ‘carbon tax’ is still a few years ahead and operating cost will add up if they take corresponding actions to improve performance in building a green environment. At present they don’t have enough personnel to deal with the ‘carbon tax’, which as a result has yet to gain enough attention.

As for transformation and upgrade, this is a long-term expenditure which, in contrast to stabilising cash flow, retaining talents, and gaining profits, is less critical in the current backdrop of tremendous cost pressure.

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.