Here Peter Standring, technical secretary at Industrial Metalforming Technologies, looks to provide a snapshot of the current, somewhat turbulent situation within the global automotive sector and suggest how this may play out for those in the fastener industry in respect to the never-ending demand and need for vehicle sustainability.

As much as some people declaim vehicles, including their uses and users, in little over a century motorised transport has changed the world and virtually all human life. This has provided freedom for the individual; low cost transport for the public; and long/short distance carriage of commercial goods. Few of even the most outspoken voices calling for the condemnation of motorised vehicles could or would ever consider a return to the horse and cart.

Vehicle development has always transitioned between what has been technologically possible and the need for commercial viability – including Formula 1.

Can it be made cost effectively? Is it safe and reliable? Is it simple and easy to repair/replace? Will it make money? These questions and a thousand like them have been asked of automotive manufacturers since the car was invented. It is the positive answers that have lead to the establishment of a market.

In the early days (as in China at the turn of this century) there were lots of vehicle manufacturers each promoting their own brand. Virtually all designs were based on a chassis where the bodywork, transmission/steering units, suspension, wheels, etc, were bolted on. The late 1940s saw the introduction of the monocoque body construction, whereby a body shell was constructed from individual parts – spot or seam welded together.

This type of construction was favoured by designers of passenger vehicles, providing freedom of style, improved stiffness and performance. Like the properties of an egg, the monocoque shell provided geometric stability but no method of attaching additional items. This led directly to the widespread adoption and use of projection welded/riveted nuts and screws – along with thousands of fasteners of all types to secure every item on every vehicle.

The recognition that the more you make the cheaper it is (Scale of Economy) led directly to the automotive OEMs embarking on a spree of acquisition and mergers to boost market share. The justification for building vehicle assembly plants was normally accepted as being based on a throughput of 70% efficiency (however that is defined). Variation of vehicle colour, engine size, etc, was determined by call off from the dealers.

As the buying public became more aware of the options available with the vehicle they bought, it was recognised that ‘Buy to Order’ offered lucrative methods of selling a vehicle. However, for customisation to work, it needed not only flexibility of the assembly line, but also throughout the supply chain. Complete assembly line flexibility for a given OEM meant having the ability to manufacture, on any sequential basis, every marque/model of vehicle the manufacturer offers in its line-up. This led to the ridiculous situation where a factorial analysis of an E-Class Mercedes showed what a customer had as ‘options’ – 1.3 trillion choices.

A further development in vehicle design was the use of spaceframe construction – primarily for the improvement of performance by the use of lightweighting. This became essential as the regulations on emissions were lowered and also to counter the significant increase in vehicle mass – brought about over decades due to safety issues.

The development of simulation software for vehicle design had clearly demonstrated how the changes in ‘second moment of area’ (second moment of inertia in the USA) can be used to achieve significant stiffness in a vehicle structure by using selectively shaped metal sheet or tubing. Whilst the properties of all materials can be assessed/compared by subjecting them to a load versus extension test (stress/strain); in practice, the performance of any material when loaded, is determined by its shape (second moment of area) and stress/strain behaviour. This is why an apparently very thin suspension arm on a F1 racing car can function the way it does when loaded according to is design function, but will fail easily if loaded in a non-designed direction. Similar to corrugated cardboard being stiff when loaded in the direction of the corrugations, but possesses very little strength between them.

The automotive industry was able to exploit this efficient use of material in vehicle design due to the developments made in the hydroforming of sheet and tubular materials. It was the use of hydroformed parts and tailor welded blanks, coupled with sophisticated software, which have provided automotive design engineers with the capability to create the mass produced lightweight body in white structures that are available today. This of course has progressed in parallel with the major progress made by developments in advanced high strength steels and aluminium alloys.

Clearly, in this fast flowing and ever changing world of technology, markets, and politics, the constant striving for scale of economies will produce further OEM consolidation. They will in turn, reduce the number of vehicle platforms and modules around which they build the product, whilst at the same time endeavouring to provide customised options to the purchaser.

Fasteners in a sustainable world

At the turn of this century China joined the World Trade Organisation (WTO). The rest of the world, including industry, considered this would lead to stability and growth. Automotive pundits then turned to the potential for vehicle ownership inside China.

The well known table listing numbers of vehicles per thousand head of population for each major country shows the USA leading, having around 800 (0.8 per person). This raised the obvious and very serious question: ‘What if vehicle numbers in the populations of China and of course India (40% of the global population), currently around 200 and 60 respectively, were to enjoy parity with the USA?’ A simple analysis suggests that if around 300 million people had 0.8 vehicles each, then 1.3 billion would require around 1 billion. Bring India into the equation and that figure naturally doubles. At the turn of this century the global annual figure of automotive production was around 75 million vehicles and in 2019, just under 92 million.

Put in these terms, automotive sustainability isn’t a matter of whether you buy a polluting vehicle or not, that’s an environmental issue. Fossil fuels are plentiful; it’s where they are which provides an economic and political problem. If it were possible to run a vehicle on air or sea water and improve the waste quality of both, that would only add to the problem of vehicle sustainability.

Of course, we can renew trees and other naturally grown products, although they are unlikely to be cost competitive against an oil based synthetic equivalent. What we can’t produce is any more of the ‘star stuff’, which was created in interstellar space through supernova explosions. Trawling the very deep seabeds for nuggets of nickel, manganese, cobalt, etc, is currently under discussion by the International Seabed Authority (ISA) and reflected in the newly agreed UN High Seas Treaty. It’s not the availability of the materials that is the problem, but the method and means by which they are obtained. Intensive suction dredging will, similar to the 19th century hydro-mining in the USA, simply wipe out the entire ecosystem.

Since mining the moon or Mars does not offer a short/medium term solution to our current extravagant waste of finite resources, perhaps ‘sensible’ recycling will?

Government regulators have little appetite to cross swords with major industrial sectors that provide significant employment and taxable income for their populations. So, as in the case of the automotive industry, when waste becomes an issue, they instruct the industry in question to sort out their own problem.

For the automotive industry, this requires them to take back the unwanted/scrapped vehicles and to ensure that the materials from which they were built are safely disposed of within the regulations. Vehicle OEMs have no financial interest in the vehicle they sold once the warranty period has ended. To them, the onus of recycling the scrap is simply an additional business tax they naturally include in the purchase price. For this reason, they offload the responsibility to ‘dealers’ who carry out the task on their behalf.

Many years ago, when a major automotive OEM this author used to work with introduced their first aluminium engine block, materials specialists from the company were tasked with finding means of scrapping these ten years down the line. In discussions, one of the specialists suggested that what the automotive industry required was a vehicle designed like those in a circus – where the clown drives around the ring waving at the crowd before a bang, sparks and the smoke clears to show the vehicle all in pieces.

This image, coupled with the fact that on virtually all scrapped vehicles most parts are perfectly serviceable, suggests that maybe, someone is missing a huge trick? Rigorous quality control (zero defects), material audits and total traceability mean that nothing on a vehicle is either unknown or left to chance. All mass produced vehicles are designed to be assembled in the most efficient manner. It naturally follows that were the assembly line to be reversed, all vehicles should be able to be disassembled in the same time. Of course, this excludes the body in white where it is welded, brazed, bonded and/or riveted.

A current business model much favoured by OEMs is to lease, rather than sell the vehicle for a fixed period (terms and conditions apply). On return, the vehicle is then sent for auction or to a dealership and eventually, scrappage.

Now, assume that a vehicle manufacturer worked with their fastener specialists to develop methods of securing vehicle modules that could be disassembled on a ‘disassembly line’ post leasing. The disassembled modules – provided by the tier 1 – could then be refurbed/upgraded (with smart sensors if required) and returned for re-assembly with full supply

chain involvement.

So, the previously leased vehicle (leasing might become the only business model for the future) could be returned to the market as a fully warranted product for another lease period. Given the statistical data obtained from this new business model, it is possible that a single vehicle could be sold and resold a number of times – significantly increasing the OEM’s business.

More importantly, from a sustainability point of view, the ability to disassemble a vehicle as easily and as cost effectively as it would be to build it, would mean that at the end of life, all parts could be recovered. Given a true and factual knowledge of all component parts, a proportion of these could then be sold on by the OEM for use in other non-automotive related products, as semi-finished stock at perhaps the same purchase price as their initial purchase? The material and manufacturing costs savings on energy, CO2, etc, could be enormous.

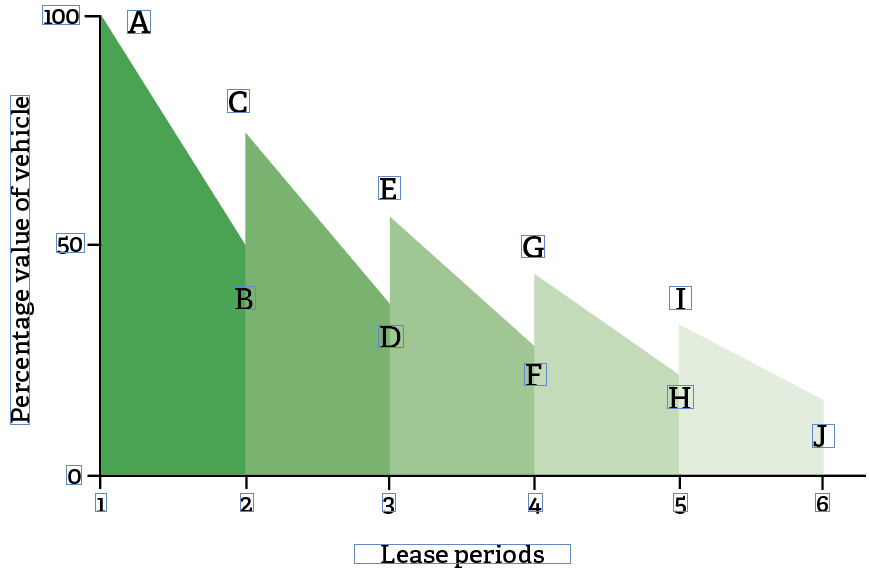

The key here is recycling that pays for itself, all made possible by having the fasteners to make it happen. The saw tooth graph shown in Figure One provides a diagrammatic representation of an automotive leasing refurbishment/recycling system. Sale values are ‘A’, ‘C’, ‘E’, ‘G’ and ‘I’, the respective depreciated values at ‘B’, ‘D’, ‘F’, ‘H’ and ‘J’. In the example shown, depreciation over the leasing period is taken at 50% of the sale value. Refurbishment costs used in the model are taken as 25% of the previous selling price. Clearly, all percentages can be varied to obtain the optimum return on investment.

The key here is recycling that pays for itself, all made possible by having the fasteners to make it happen. The saw tooth graph shown in Figure One provides a diagrammatic representation of an automotive leasing refurbishment/recycling system. Sale values are ‘A’, ‘C’, ‘E’, ‘G’ and ‘I’, the respective depreciated values at ‘B’, ‘D’, ‘F’, ‘H’ and ‘J’. In the example shown, depreciation over the leasing period is taken at 50% of the sale value. Refurbishment costs used in the model are taken as 25% of the previous selling price. Clearly, all percentages can be varied to obtain the optimum return on investment.

Through involvement in this model the supply chain will share both the costs and benefits. Also, in-service life data will improve both quality and performance. Most importantly, refurbishment and recycling will create a direct benefit to encourage the design/development of quick action fasteners for attaching/detaching both pre-assembled modules and the modules themselves. Such a model could become the ‘norm’ for other sectors that deal in manufactured goods.

Conclusion

The war in Ukraine introduced an energy crisis not seen since the Arab-Israeli War of 1973. Those driving electric vehicles were pleased they didn’t have internal combustion engines (ICEs) until they too realised the increase in electricity charges. At the time of writing this article, the sales of electric vehicles have slumped due presumably to the higher purchase costs over non-ICE vehicles and the inconvenience of battery charging. On the other hand, the prestige of Tesla and sales of its vehicles are increasing.

It should be recognised that in the context of this article, the purchase and use of non-ICE vehicles is an environmental choice not one of sustainability. Despite requiring fewer components (ICE and transmission) and having a skateboard chassis, the manufacturing ‘footprint’ of electric vehicles is virtually the same as all other vehicles although the servicing is significantly less.

Tesla and other automotive manufacturers are lauding the fact that their ‘giga’ battery factories will provide a fully recyclable facility for their power units. Whilst this is encouraging, although difficult when the battery itself is designed as part of the vehicle structure, it does provide a start in the quest for vehicle sustainability.

However, at this stage, it is not unlike the introduction of lightweight aluminium spaceframe/bodied vehicles, which were developed to improve fuel efficiency and performance. This became less attractive and something of an embarrassment when it was realised that in a country the size of the USA – where vehicle ownership rated the highest in the world – initially, there were only four garages capable of effecting warranty repairs on aluminium alloy vehicles. Things did change, along with the cost of insurance (not very different to the early scrappage of crash damaged electric vehicles today).

In many countries, legislation exists to ensure that every scrapped vehicle belongs to the OEM even though they may only make a small percentage of the whole. Over many years, the general profit margin of the OEM has averaged out at half that of their suppliers and only one third that of the dealers. Given this, it is quite astonishing that the industry has been so casual in tossing out, with little regard, what it has worked so hard to create.

Tesla has attempted to break the conventional automotive supply chain by re-energising Ford’s initial concept of vertical integration. However, this has been largely focused on digitisation, software development/application and electronic integration. For much of the rest of the vehicle, Tesla has, like all other OEMs, conventional supply chain partners.

If Elon Musk were to apply the concept of his ‘giga’ battery recycling facilities to the whole of the vehicle as proposed above, then every vehicle could have a number of affordable ‘leasing’ periods and still provide a payback at the end of life. The starting point would be a programme of discussion with fastener designers and manufacturers to create the means by which this could be made possible.

As for the sustainable future? This would involve a global automotive industry that provides safe, reliable, multi-price point vehicles through a local network, supported by regional OEM new build/disassembly plants and their satellite supply chain partners. The key, the right fasteners, in the right quantity, in the right place, at the right time. Given that, everything else is simple!

Will joined Fastener + Fixing Magazine in 2007 and over the last 15 years has experienced every facet of the fastener sector - interviewing key figures within the industry and visiting leading companies and exhibitions around the globe.

Will manages the content strategy across all platforms and is the guardian for the high editorial standards that the Magazine is renowned.

Don't have an account? Sign Up

Signing up to Fastener + Fixing Magazine enables you to manage your account details.