Thomas Ehrhardt

19 July 2016

President global automotive, STANLEY Engineered Fastening

In 2013 the acquisition of Infastech took STANLEY Black & Decker’s global engineered fastening sales to around US$1.5 billion. This June, Thomas Ehrhardt assumed global responsibility for its automotive segment. He talked to Executive Editor Phil Matten about the benefits of that acquisition and reflected on what it takes to respond to, but equally importantly anticipate, the needs of the global automotive industryThe automotive industry has absorbed most of Thomas Ehrhardt’s twenty year fastener industry career. Previously with TRW Engineered Fasteners & Components, Ehrhardt joined Tucker GmbH as head of sales in 2005. His responsibilities expanded, initially adding marketing to his portfolio and later taking on automotive engineering responsibility for the European market. In April last year he was appointed managing director of Tucker GmbH, and last month became president of STANLEY Engineered Fastening Global Automotive.

Responding to the suggestion there had been a period of introspection after the 2013 Infastech acquisition, Ehrhardt smiles. “If you look at STANLEY Black & Decker’s track record, it definitely has massive experience in acquiring and integrating companies. The Infastech acquisition has been one of our most successful, exceeding both revenue and cost expectations. It has been a good integration.”

That wasn’t too difficult, Ehrhardt says, given these were two strong companies. “Emhart already had Tucker®, POP® AVDEL and its other brands, as well as a lot of good people and excellent products. Gaining both sales channels, and putting the two portfolios together, meant we were able to position ourselves far more strongly in the global automotive market.” Yes, he acknowledges, it takes time to build on the momentum gained from an acquisition. “First you must make sure you have your organisation and structure in place. Now we are very definitely in the position to harvest the benefits.”

The synergies for the automotive segment are already demonstrated through a series of recent market initiatives and product launches. There is more, though, says Ehrhardt. “There is another huge aspect when you look at the industrial and electronics segments – further very important reasons for the acquisition as part of a process of diversification.”

For the automotive business it is about “what the acquisition has already brought, and, more importantly, what it will bring”. Synergies in blind riveting technologies presented significant gains in operational excellence and manufacturing capability. On the other hand channelling strong products to the right customers is proving profitable already. “Products like Avseal® provided superior solutions but lacked some customer access. Now we are positioning that product in the right segments with the right customers and are feeling real momentum.”

“Analysing AVDEL, we found significant value for the rest of the organisation, which we were quick to adopt.” There have been few changes to the manufacturing footprint around Giessen in Germany, where Ehrhardt is based, although production was relocated from the UK Tucker plant to gain manufacturing efficiencies. Giessen has also benefited from a €20 million targeted investment. “We just began shipping from a new 10,000m2 plant here – built in nine months and three weeks from the ground up,” says Ehrhardt. That joins a global manufacturing network, which includes five factories in Germany, with additional manufacturing in the Czech Republic and the Warrington site in the United Kingdom. As connectivity becomes a key vehicle technology, the sector is drawing strongly from the smartphone industry, and Infastech’s strength in the electronic sector presents further substantial opportunities. “Look at the modules now being used in the automotive industry and there is a clear opportunity because of the common heritage – sometimes even the same customers. That is very interesting.”

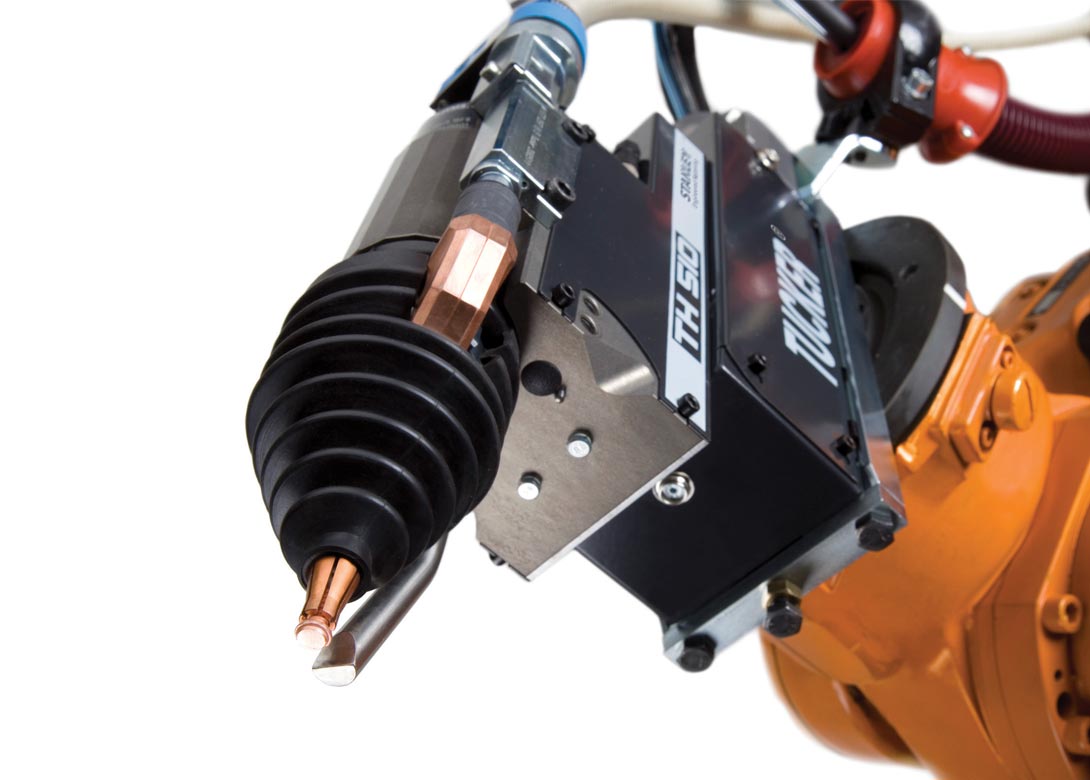

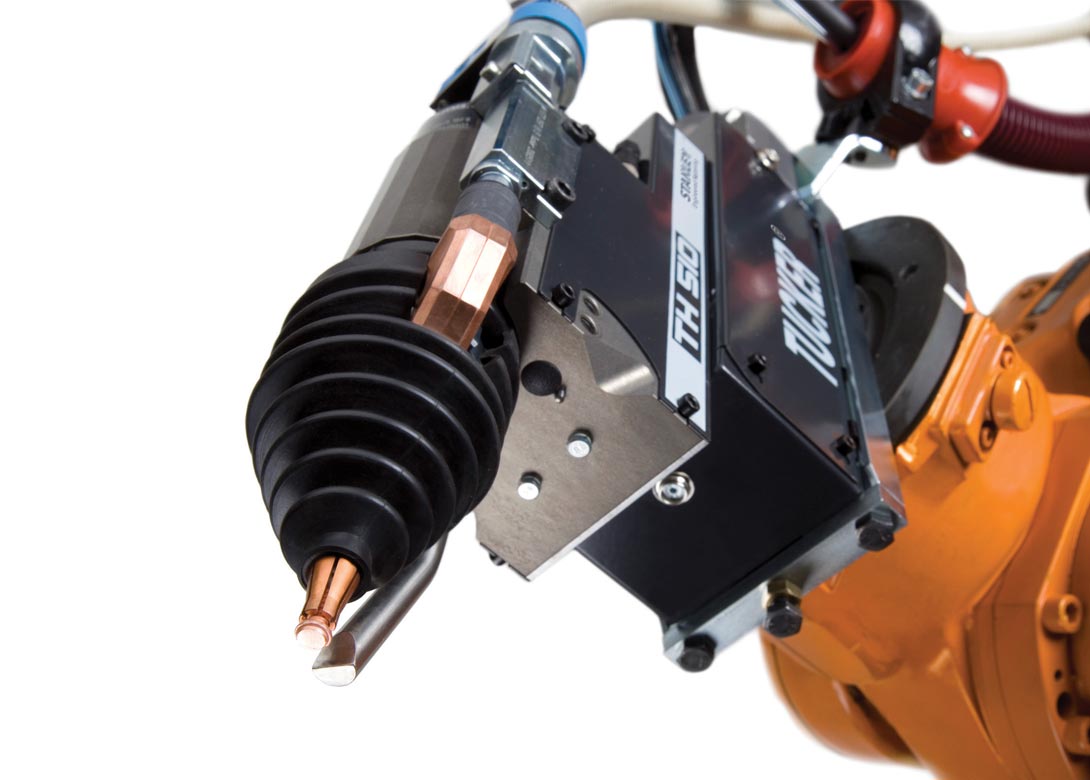

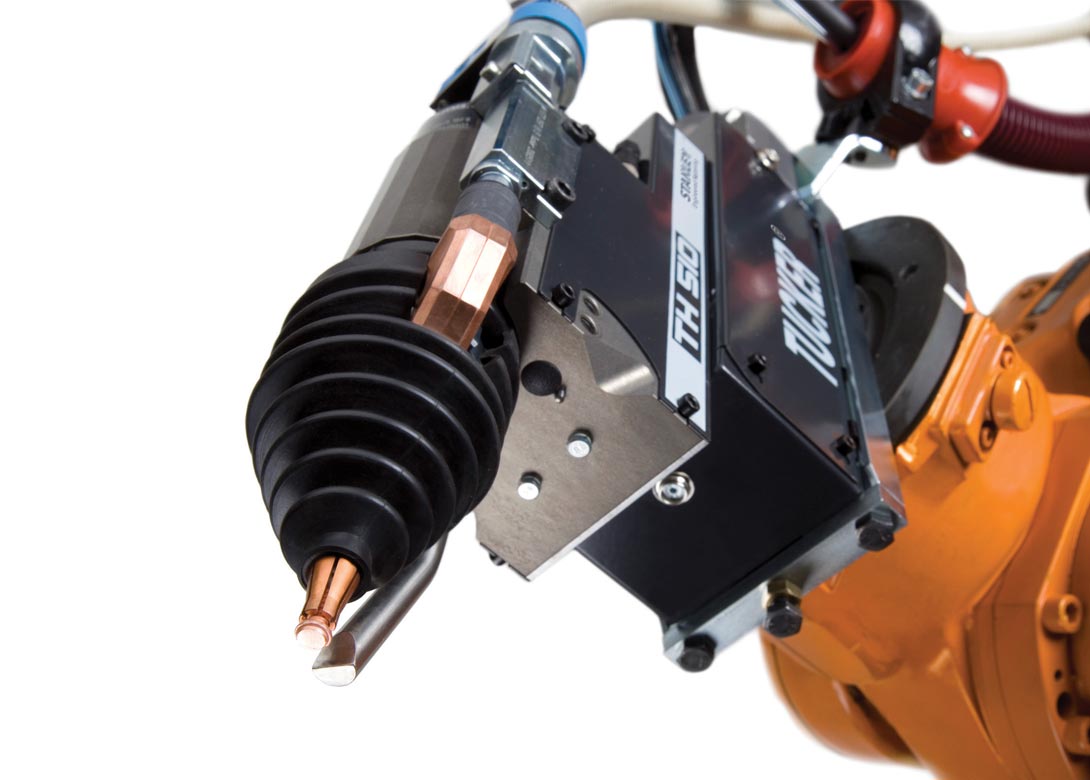

“While we have been strong in the automotive tier industry and the traditional OEMs (there is hardly a car produced in Europe without products from STANLEY Engineered Fastening) there are newcomers supplying modules to the car makers, and here we see real benefit from the combined strength gained from the acquisition.” Fundamentally important to STANLEY Engineered Fastening is its capability to manufacture and supply the complete fastening technology portfolio for the vehicle body: “Plastic components, blind riveting, stud welding, self piercing riveting – we supply the complete system.” “We are involved from the outset,” emphasises Ehrhardt. “We do not normally manufacture to print. Our intention is always for the customer to engage with us years before the body of the car appears on the street. Sometimes that is three years, sometimes five, even ten years when it comes to enabling new technology.”

“We work closely with the customer during design and simultaneous engineering phases. Sometimes we even develop the joint for the customer – recommending which product to use. We also design and supply the system that installs the fastener on the line. We support and maintain that system, we supply the spare parts, and we train the customers’ operatives. That is the STANLEY Engineered Fastening difference.”

That needs highly skilled people close to key customer locations. “We have the right people in place in our offices in France and Italy, in Spain and the UK, in Sweden and eastern Europe, as well as in Asia and American locations. Wherever the automotive industry is we have a presence and a set of knowledgeable engineers.” Different stages in the vehicle life cycle demand distinctive skill sets. Early design and development consultancy demands very specific capabilities. Application engineering, translating concept to the assembly line and, when necessary, resolving specific issues encountered as the vehicle moves into production, requires others. Nor are these purely reactive roles. “There are times when we proactively approach the customer,” explains Ehrhardt, “because we recognise the potential for a cost reduction or elimination of a quality issue.” Distinct, yet again, are the people required to install, maintain and service the production equipment.

“Throughout, most important for us is to fully understand the customer,” he continues. “It is not these people’s job to talk only with the purchasers. Of course, it is necessary to understand their expectations but it is not where the work is really done. It is understanding the assembly process, where a product can create value, and addressing the customer’s quality issues, maybe also their supply chain concerns.”

“A fastener only differentiates from that of a competitor by the way it meets the customers needs or how it is designed to solve a problem. You can only understand that if you are really close to the customer. Most of our people have been with us for at least ten years. They are industry experts. They are very well connected with their customers, with product engineering, with manufacturing engineering. They spend a lot of time where our products are used to understood how we can improve – line walks, assembly studies, providing added value engineering. Above all, ensuring we are always up to date.”

The imperative for lightweighting and the associated challenges of multi-material body assembly demand that STANLEY Engineered Fastening engineers are immersed in what is happening in research laboratories, universities and the advanced engineering departments of its customers. “This is crucial in anticipating customer needs. Working with these facilities means we are able to bring an external view on what we believe is going on.” STANLEY Engineered Fastening also works closely with the developers and manufacturers of advanced materials, and the automotive OEMs’ own research and development departments. “The people involved in vehicle body fastening may not know what is coming to them,” says Ehrhardt. “We try to anticipate as well as we possibly can the joining, plastic fastening, tightening, welding or riveting issues they may face in the future.”

“Lightweighting presented, and continues to present, a huge challenge for the automotive industry. We are particularly proud of our ability to turn that challenge into an opportunity. We have found ways to help our customers, which have driven so much growth into our organisation over recent years, as well as strengthening the integrity of our customer relationships.”

“We want to achieve an exchange between the customers’ and our own technology roadmap. Of course, we want to understand and respond effectively to their concerns today but we must also anticipate the challenges of ten, maybe fifteen years from now. Ten years in the automotive industry is nothing – decisions being made today will be out there in ten years time.”

There are other convergences, not least in how the automotive industry thinks and acts globally. “We recently decided to reorganise our global automotive structure,” explains Ehrhardt. “While that was mainly about customer focus, it is also about global product line cohesion.” There remains distinctive influences on assembly techniques depending on the origin of the carmaker. “There is a difference in the way an Asian car manufacturer typically assembles a car, compared with a European or American one. A German OEM will invest in the same technology whether manufacturing in Europe, in America or Asia. It will make one decision on a standard process, to be used in all regions. However, the pros and cons for an Asian or American OEM may not be the same.”

“We are very successful in Japan but the use of blind riveting in a Japanese car as opposed to stud welding is significantly different. It is not about judging whether one technology is better than the other. Both make sense and that is linked to the manufacturing strategy of the customer. It is not up to us to teach what is better: It is up to us to understand why the customer is going in that direction and to take that journey with them.”

Ehrhardt hints at growing commonality. “We use self-piercing rivet technologies with virtually every OEM and in every region. The degree of emphasis on that technology definitely differs right now but there is a clear probability of convergence over time.”

Part of the responsibility Ehrhardt sees for STANLEY Engineered Fastening is to ensure that increased complexity in the carmakers’ product profile, driven by a rapid growth in consumer expectations of a distinctive personal vehicle, does not feed back into unnecessary complexity in production. He cites examples: “Developments in our TR 610 weld head now enables it to weld completely different studs. It is a higher one time investment but longer-term flexibility is ensured.” For self-piercing rivet technology: “We came out with products where you invest once in control unit, the feeding unit, and the setting unit, but then you have tools that increase the flexibility. We make sure it is not one investment for one model. Similarly we work on standardisation of the fasteners used.”

The process doesn’t stop at the assembly line. “If the customer doesn’t think about it, and most do, then we try to come up with a concept for reparability from the beginning. Some of our blind rivets are used as a repair solution for stud welding. Yesterday, we made the decision to invest in a specific solution to repair products at the car dealers. If we don’t have a repair solution, in the assembly plant if something goes wrong, or at the car dealership, it may be a reason why our product is not used.” Drawing it all together, Thomas Ehrhardt believes: “Our commitment to the success of our customers means anticipating their future needs today, constantly advancing the technologies we provide to solve fastening and assembly issues, and most especially providing a total system that ensures customer productivity is maximised and lowest possible cost achieved.”

Next time: Thomas Ehrhardt talks more about lightweighting and the challenges of multimaterial vehicle bodies, and looks towards the possibilities for further disruptive developments in vehicle technologies.